How to Start Investing in the Stock Market: A Beginner's Step-by-Step Guide

Introduction to Stock Market Investing for Beginners

Starting to invest in the stock market can feel overwhelming, but it’s one of the most effective ways to grow your wealth over time. The stock market allows you to buy a piece of a company and share in its growth. However, before diving in, it’s crucial to ensure that your financial foundation is strong. This guide will walk you through the essential steps to prepare yourself for investing and help you make informed choices as you start your investment journey.

Step 1: Understand Your Financial Health

Before making any investment, it’s important to assess your financial health. This involves taking a closer look at your debts, savings, and overall financial obligations. Here’s what you need to know:

Good Debt vs. Bad Debt

Not all debt is created equal. Good debt includes things like a mortgage or student loans that help build assets or increase future earning potential. Bad debt, on the other hand, usually comes with high interest rates, like credit card debt or payday loans. Bad debt can weigh heavily on your finances and eat into any returns you might make from investing.Importance of Paying Off Debt First

If you have high-interest bad debt, it’s essential to prioritize paying it off before you start investing. For example, if you’re paying 20% interest on a credit card, it doesn’t make sense to invest in the stock market, where average returns are around 7-10% per year. Clearing bad debt gives you a clean slate and ensures that the money you invest will work for you without being drained by interest payments.

Step 2: Build an Emergency Fund

Once you’ve paid down any bad debt, the next step is to create an emergency fund. This is a crucial financial safety net that can protect you from unexpected expenses or life events, allowing you to avoid dipping into your investments during tough times.

How Much to Save

A general rule of thumb is to save between 3 to 12 months of living expenses, depending on your job stability and ease of finding new work. If your job is more secure, a smaller emergency fund of around 3 to 6 months might suffice. However, if you’re in a volatile industry or self-employed, you may want to aim for 9 to 12 months of savings.Why an Emergency Fund Matters

An emergency fund gives you peace of mind and keeps you from selling your investments during a market downturn or financial emergency. Having this cushion allows you to invest with confidence, knowing that your day-to-day finances are protected.

Step 3: Safeguard Your Cash in a Risk-Free Interest Account

Once you’ve established your emergency fund, you’ll want to ensure that any extra cash you set aside is kept in a safe place where it can earn interest without risking loss.

Risk-Free Interest Accounts

High-yield savings accounts or money market funds are excellent choices for storing your emergency fund or any cash you want to keep accessible. These accounts offer interest with minimal risk, meaning your money will grow slowly over time while staying liquid and accessible.Why Choose Zero-Risk Accounts

While it’s tempting to invest every dollar you have, it’s important to keep some cash in zero-risk accounts. These funds serve as a buffer, ensuring that in case of emergencies or short-term needs, you don’t have to sell your investments at an inopportune time.

This foundation will ensure that you’re financially prepared to start investing in the stock market, and it sets the stage for making smarter investment decisions going forward.

Step 4: Start with Low-Risk Investments: ETFs

Once you’ve built a strong financial foundation, it’s time to start investing. For first-time investors, Exchange-Traded Funds (ETFs) are a great place to begin because they offer a diversified portfolio with relatively low risk.

What Are ETFs?

ETFs are investment funds that hold a basket of stocks, bonds, or other securities. When you buy an ETF, you’re purchasing a small slice of each asset in the fund. This provides instant diversification, reducing your risk compared to buying individual stocks.Why ETFs Are Ideal for Beginners

ETFs are less risky than individual stocks because they spread your investment across many companies, sectors, or markets. Instead of putting all your money in one stock, you’re investing in a whole group, which helps protect you from volatility.Tracking ETFs on ML Alpha

ML Alpha offers tools to track various ETFs, including those focusing on ESG (Environmental, Social, and Governance) factors, emerging markets, and more. By using our platform, you can explore different types of ETFs that match your investment goals, while also getting insights from data scientists and market experts.

Step 5: Boost Performance by Following Top Investors on ML Alpha

Once you have a foundation with safer investments like ETFs, you may want to consider allocating a portion of your portfolio to strategies that could offer higher returns. On ML Alpha, you can follow top investors and data scientists who share their portfolio strategies, helping you potentially boost your performance.

Why Follow Top Investors?

The stock market is complex, and even seasoned investors can struggle to consistently outperform the market. On ML Alpha, you can leverage the expertise of investors and data scientists with proven track records. By following their portfolios, you can benefit from their insights without having to do all the research yourself.The Power of Compounding Returns

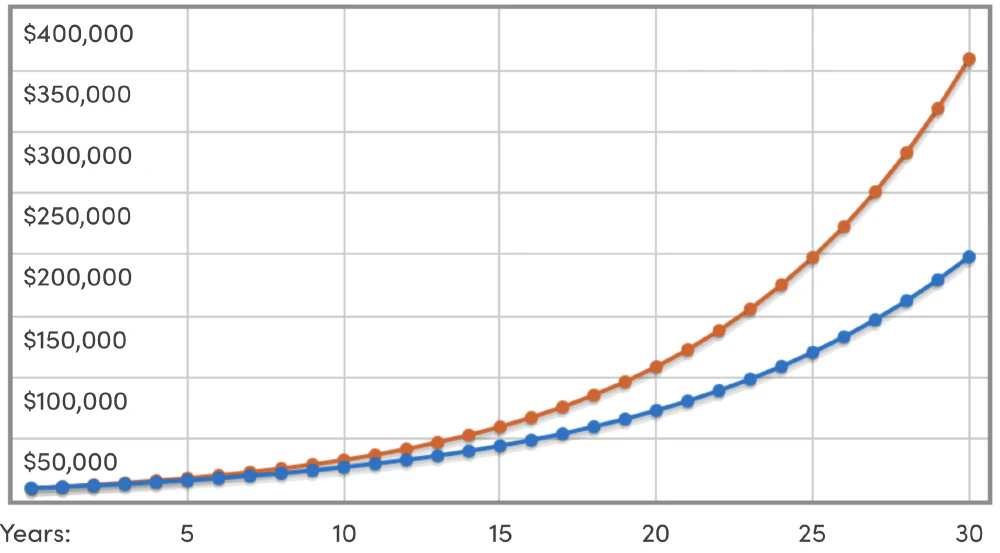

Small increases in your annual return can have a significant impact over time. For instance, a 1-2% higher return might not seem like much in the short term, but over 20 to 30 years, this can lead to exponential growth in your wealth. By reserving a portion of your portfolio for higher-risk, higher-reward strategies, you can potentially achieve better long-term outcomes.

Difference of 2% over 30 years

Step 6: Reserve an Allocation for Extra Performance

One of the key strategies for long-term investors is to allocate a portion of your portfolio to potentially high-performing assets. While it’s important to keep most of your investments in low-risk vehicles like ETFs, reserving a small percentage for higher-growth opportunities can have a huge impact on your overall portfolio.

Why Extra Performance Matters

Over 20 to 30 years, even a small portion of your portfolio dedicated to high-growth investments can significantly boost your total returns. Whether it’s following top investors on ML Alpha or identifying emerging market trends, these higher-risk allocations can supercharge your portfolio’s growth.Balancing Risk and Reward

While you want to capture extra performance, it’s also important to manage risk. By keeping most of your portfolio in lower-risk assets and allocating a smaller portion to more aggressive strategies, you can balance the need for growth with financial security.

Together, these steps will give you a clear roadmap for getting started with investing in the stock market. Following this process ensures you build a strong financial foundation while also giving yourself room to grow your wealth through strategic investments.

Step 7: Taking the First Step: Start Small and Learn as You Go

Now that you’ve laid the groundwork for your financial health and investment strategy, it’s time to take the plunge. Starting small and learning as you go will build your confidence and help you become a smarter investor over time.

Start with a Small Investment

You don’t need to commit large amounts of money to begin. Start with a small portion of your savings that you can afford to invest long term, and gradually build your portfolio as you gain more experience and comfort.Stay Consistent

Investing regularly, even in small amounts, can lead to significant growth over time. Many investors follow a dollar-cost averaging strategy, which means investing a fixed amount of money at regular intervals, regardless of market conditions. This helps to reduce the impact of market volatility.Keep Learning

The stock market is always changing, and there’s always something new to learn. Take advantage of resources like ML Alpha to track portfolios, analyze market trends, and follow top investors. Stay updated on the latest financial news and continually refine your strategy.Review and Adjust as Needed

Periodically review your portfolio to ensure it aligns with your goals and risk tolerance. As you become more experienced, you may want to adjust your allocations or explore new investment opportunities.

By following these steps, you’ll be well on your way to becoming a successful investor. With patience, discipline, and continuous learning, you can build long-term wealth and achieve your financial goals.