How to Use AI for Investing in the Stock Market

Leveraging AI for Stock Picking

Artificial Intelligence (AI) is transforming how we pick stocks by using advanced algorithms to detect patterns that might lead to profitable investments. Here’s how it works:

AI models are trained to recognize patterns and trends in vast amounts of financial data, giving them the ability to predict which stocks have a higher probability of success. This process involves analyzing historical stock performance, company financials, macroeconomic variables and/or various other market indicators.

The effectiveness of AI in stock picking also depends on the specific investment strategy being used. Whether you prefer a conservative approach or a more aggressive one, AI models can provide insights and be adapted to suit different styles of investing.

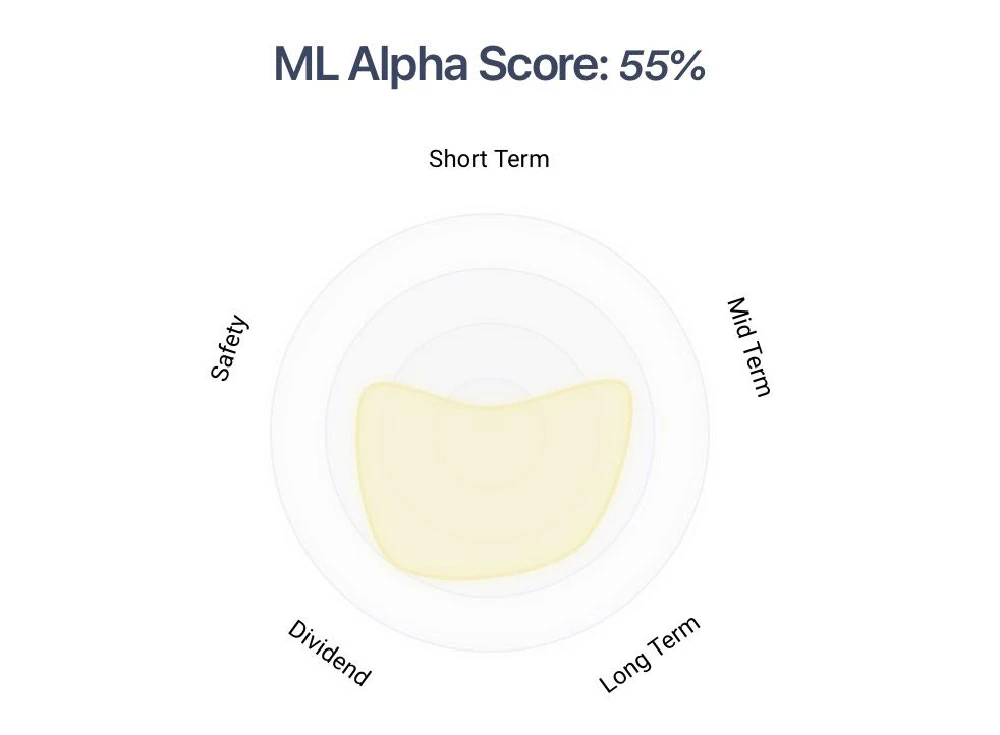

For example, in our ML Alpha AI Scores shown in the chart above, we provide various metrics to help investors make informed decisions:

- Short-Term Performance Probability: Estimates the likelihood of stock performance over the next 1 month.

- Medium-Term Performance Probability: Assesses the potential performance over 3 to 6 months.

- Long-Term Performance Probability: Predicts how the stock might perform over 1 to 3 years.

- Dividend Probability: Indicates the likelihood that the stock will pay dividends in the future.

- Safety Probability: Evaluates the expected volatility and risk of loss in value for the stock over the next 3 months to 1 year.

These metrics are designed to give you a clearer picture of potential stock performance and investment risks.

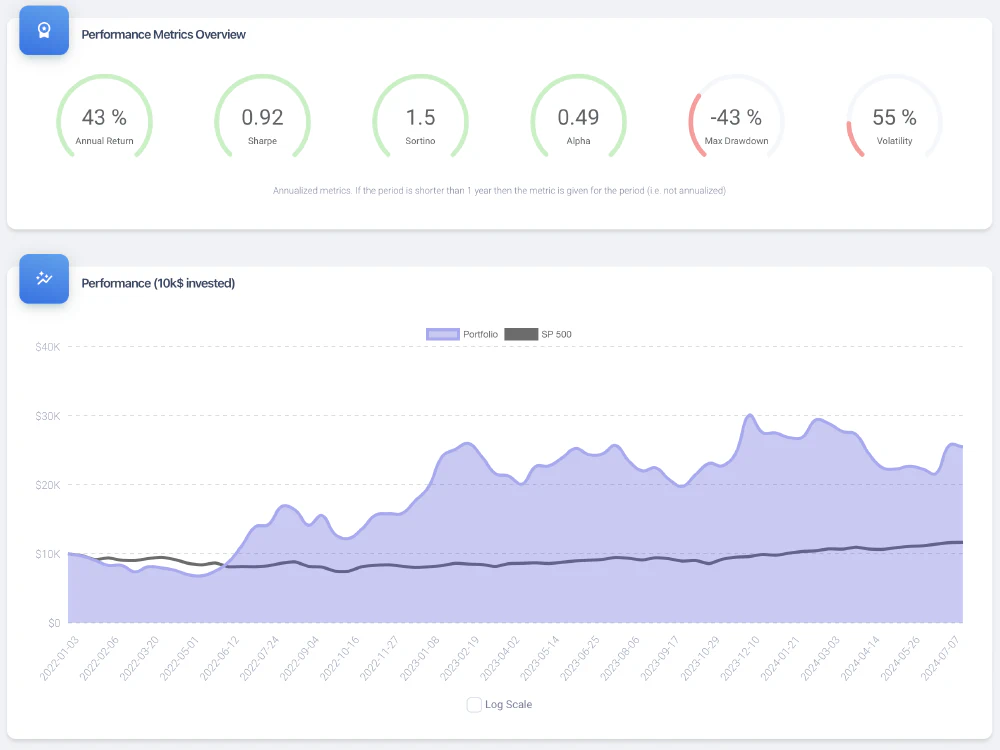

One crucial aspect to check before leveraging AI for any stock picking strategy is its backtesting. This means testing the strategy with the AI models on unseen and unbiased data to ensure they perform well in real-world scenarios. By doing so, investors can have more confidence that the AI-driven predictions are reliable and not just a result of overfitting to past data.

In summary, AI can significantly enhance stock picking by identifying profitable opportunities and adapting to various investment strategies, provided robust backtesting has been conducted to validate its predictions.

Assessing Investment Risks with AI

When it comes to investing, understanding and managing risk is crucial. Artificial Intelligence (AI) can be a powerful tool in this regard, helping investors make more informed decisions. Here’s how AI can assist in assessing investment risks:

Detecting Patterns in At-Risk Companies: AI algorithms can analyze vast amounts of data to identify patterns that may indicate a company is at risk of failing in the coming months or years. By examining financial reports, market trends, and other relevant factors, AI can provide early warnings about potential problems, allowing investors to make timely adjustments to their portfolios.

Predicting Stock Volatility: AI can also predict the volatility of stocks based on current market conditions. Volatility refers to how much the price of a stock is expected to fluctuate over a given period. By analyzing market signals, news, and historical data, AI can forecast periods of high volatility, helping investors understand the potential risks and rewards associated with their investments.

Using AI to assess investment risks not only enhances the decision-making process but also provides a layer of security by identifying potential issues before they become significant problems. This approach enables investors, even those with less financial knowledge, to navigate the stock market with greater confidence and efficiency.

Optimizing Portfolios Using AI

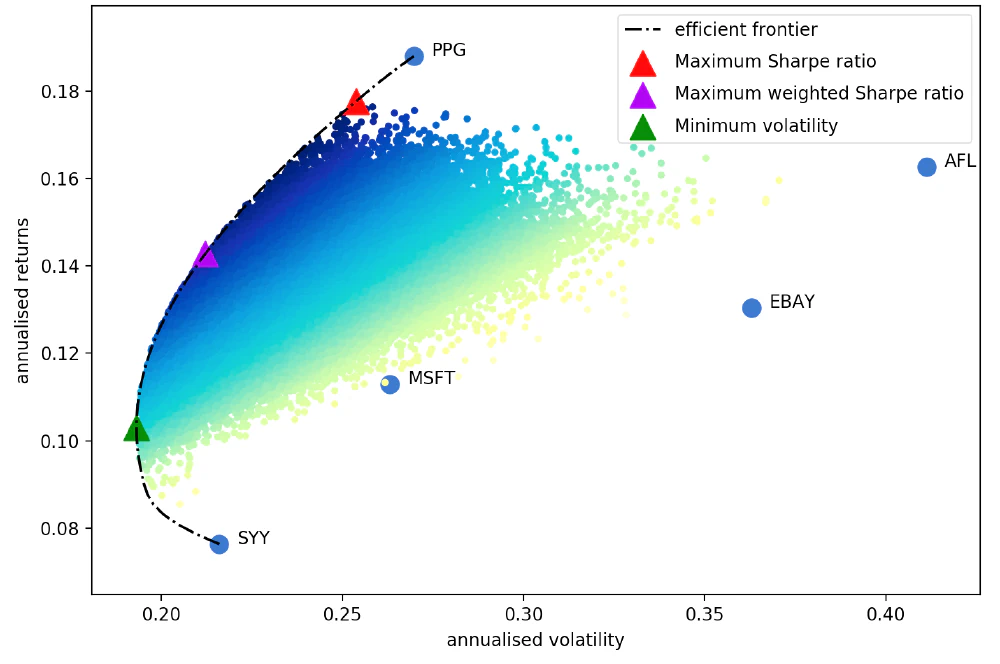

In the world of investing, finding the right mix of stocks to include in your portfolio is crucial for maximizing returns and minimizing risk. Traditionally, this process was guided by a concept introduced in 1952 by economist Harry Markowitz, known as the “Efficient Portfolio.” This method focuses on balancing risk and return based on historical data, helping investors build portfolios that aim to achieve the highest possible returns for a given level of risk.

However, the Efficient Portfolio method has important limitations: it primarily relies on historical data to forecast future returns, assumes that returns are normally distributed, and focuses solely on price behavior without incorporating fundamental analysis, macroeconomic indicators, or technical factors.

Modern Artificial Intelligence (AI) bring a new level of sophistication to portfolio optimization. AI techniques, such as Neural Networks (e.g. CNNs, LSTM’s or Transformers), are able to better approximate future stock prices behaviour by analyzing complex and highly non-linear relationships between hundreds of features from historical price data, company financials and/or current market conditions.

By incorporating AI, investors can potentially build portfolios that are better equipped to handle future market changes, rather than just relying on historical trends. This means AI can help you stay ahead of the curve, making more informed investment decisions and optimizing your portfolio for better performance.

Automated Trading with AI Bots

Automated trading with AI bots is transforming the stock market trading landscape by using technology to make decisions for you. While our platform, ML Alpha, currently doesn’t offer this feature, it’s a fascinating area of AI that helps investors navigate the market.

How It Works: AI bots can learn how to trade by using a technique called reinforcement learning. Imagine a bot as a student learning to play a game. It starts with no knowledge and makes random moves. When the moves result in positive outcomes (like making a profit), it gets a “reward.” If the moves result in losses, it gets a “punishment.” Over time, the bot learns which strategies lead to the best results and adjusts its approach accordingly. And the best is that the learning can happen off-line in simulators.

After the learning phase these AI algorithms can be used to:

- Buy or Short Stocks: Decide when to buy or sell stocks based on real-time patterns in the data.

- Rebalance Portfolios: Automatically adjust the mix of investments in a portfolio to maintain a desired level of risk and return.

In essence, automated trading with AI offers a cutting-edge way to potentially enhance your investing strategy by allowing sophisticated algorithms to handle the heavy lifting that would otherwise require significant human effort and skill. If you’re curious to dive deeper into how these AI bots work, you can explore research papers and code available here:FinRL on GitHub.

Steps to Start Investing with AI

1. Define Your Investment Goals and Risk Tolerance

Before diving into AI-driven investing, it’s crucial to start with clear investment goals and understand your risk tolerance. Here’s how to get started:

Define Your Investment Goals: Think about what you want to achieve with your investments. Are you saving for retirement, a major purchase, or simply looking to grow your wealth? Clear goals will guide your strategy and help you measure success.

Determine Your Investment Horizon: Consider how long you plan to stay invested. Are you looking at short-term gains or long-term growth? Your investment horizon will influence the type of AI tools and strategies that suit you best.

Evaluate Your Existing Assets: If you already own safer investments like Exchange-Traded Funds (ETF’s), you have a foundation of stability. AI-driven investments can be more volatile, so balancing them with your existing assets can help manage risk.

Understand the Volatility: AI-based investments can sometimes experience significant fluctuations. For example, it’s possible to see temporary losses of 50% or more. Ask yourself if you’re comfortable with this level of risk, especially if your financial situation is sensitive to such swings.

Create a Balanced Strategy: Combining a stable wealth strategy with AI-driven investments can be a good approach. By blending traditional investments with AI for potential extra gains, you can aim for a balance between stability and performance.

By carefully defining your goals and understanding your risk tolerance, you can better utilize AI tools in a way that aligns with your financial situation and objectives.

2. Conduct Thorough Research

When it comes to investing with AI, it’s important to remember that while AI can offer valuable insights, it’s not a magical solution. AI tools such as ML Alpha analyze vast amounts of historical data to identify trends and probabilities, but they don’t predict the future with certainty. Think of AI as a smart assistant that helps highlight potential opportunities, rather than a crystal ball that guarantees outcomes.

To make the most of AI-driven investing, you should still do your own research. Use the information AI provides as one piece of the puzzle, but combine it with your own analysis and understanding of the market. This approach ensures you make well-informed decisions rather than relying solely on automated recommendations.

3. Practice Patience and Discipline

When using AI for investing, it’s important to remember that results might not be immediate. Just like with any investment strategy, it can take time for AI-driven approaches to show their full potential. Patience is key here.

Stick with your chosen AI tools and strategies consistently. Making changes too quickly based on a single result can lead to misleading conclusions, as the investment environment is inherently unpredictable. Instead, give your AI strategies time to prove their effectiveness. Only make adjustments after observing a pattern over several tests, not just one. This approach helps ensure that your decisions are based on solid, long-term evidence rather than short-term fluctuations.

What Data Can AI Analyze for Investing?

Artificial Intelligence (AI) can use a variety of data sources to make smart investment decisions.

Here’s a simple breakdown of the potential data sources:

Technical Data: This involves analyzing historical stock prices, trading volumes, and other technical indicators like moving averages and relative strength index (RSI). These indicators help AI to identify patterns and predict future price movements.

Fundamental Data: This includes information from company earnings reports, such as revenue, profits, and growth rates. This data helps AI understand a company’s financial health.

Market Data: AI looks at complex data related to stock prices and market trends. This helps in tracking how stocks are performing over time and predicting future movements.

Economic Data: AI also considers broader economic indicators like inflation rates, interest rates, and economic growth. These factors can influence overall market performance.

Sentimental Data: This involves analyzing news, social media, and other sources to gauge public sentiment about a stock or the market in general. Positive or negative sentiments can significantly impact stock prices.

At ML Alpha we currently leverage technical, fundamental, market and economic data. However, we continually seek to expand our dataset to improve our chances of outperforming the stock market. We anonymize this data and provide it to top data scientists who use it to create advanced AI models designed to give you an edge.

If you’re a data scientist interested in working with this data, check out our ML Alpha Advanced Data Science Studio to get started.

Is It Safe to Invest with AI?

Investing with AI can sound exciting, but it’s important to understand the risks and benefits. Here’s what you need to know:

AI Strategies Aren’t Always Safer: While AI can offer sophisticated analysis, it doesn’t inherently make investments safer. The performance of AI-driven strategies is generally similar to traditional methods, except in high-frequency trading, which is typically reserved for large hedge funds.

AI Can Enhance Performance: One area where AI shines is in identifying promising small-cap companies. Our experience suggests that AI can be particularly effective in spotting future growth opportunities in this sector.

Careful Allocation is Key: As with any investment approach, it’s crucial to manage how much of your portfolio is allocated to AI-driven strategies. Make sure to define your overall investment goals and strategies first. This will help you use AI effectively while maintaining a balanced and diversified portfolio.

By understanding these points, you can make more informed decisions about incorporating AI into your investment strategy.

Bottom Line

Artificial Intelligence (AI) is transforming investing by making stock selection, risk assessment, portfolio management, and trading more efficient. Here’s a simple overview of how AI can help you invest smarter:

Stock Picking: AI shifts through massive amounts of data to spot promising stocks and can adapt to various investment strategies. It shall always be robustly backtested to ensure its predictions are reliable.

Risk Assessment: AI identifies patterns that could signal potential risks and forecasts stock volatility. This helps you make more informed decisions and avoid unexpected losses.

Portfolio Optimization: AI goes beyond traditional methods by predicting relative future stock trends and suggesting the best stock combinations to create a balanced and profitable portfolio.

Automated Trading: AI bots handle trades and adjust your portfolio automatically based on current market data, making trading more precise and less time-consuming.

To begin using AI in your investments, start by setting clear goals and understanding your risk tolerance. Do thorough research and stay patient and disciplined. While AI can significantly enhance your investment strategy, it should complement, not replace, your overall approach.

By using AI effectively, you can make better investment choices and potentially see improved results in the stock market.

Start building your portfolio today with our AI-powered stock picks tailored to your specific needs.