Is the Stock Market Set to Grow in 2025? Unveiling Key Trends and the Role of AI

What is the Stock Market?

The stock market is a marketplace where individuals and institutions buy and sell shares of publicly traded companies. Essentially, it allows businesses to raise capital by selling ownership stakes to investors. The market acts as a barometer of economic health, reflecting the collective performance of businesses. When companies thrive, their stock prices tend to rise, pushing market indices like the S&P 500 higher.

One important aspect of the stock market is that it’s driven by both company performance and investor sentiment. Investors are constantly analyzing market conditions, earnings reports, and future growth prospects, making decisions that affect stock prices daily.

Why the Stock Market Grows: Efficiency as the Key Driver

The stock market grows primarily because of increased efficiency in the way companies operate. Over time, businesses improve their operations, reduce costs, and leverage new technologies. These advancements lead to higher profits, which attract more investors and drive stock prices upward.

Market efficiency also plays a critical role. When investors believe in a company’s ability to produce earnings and maintain growth, they invest, leading to price increases. Efficiency can come from operational improvements, innovations, and economies of scale, all of which help businesses generate higher returns.

Analyzing the Data: S&P 500 Price vs. Earnings per Share (EPS)

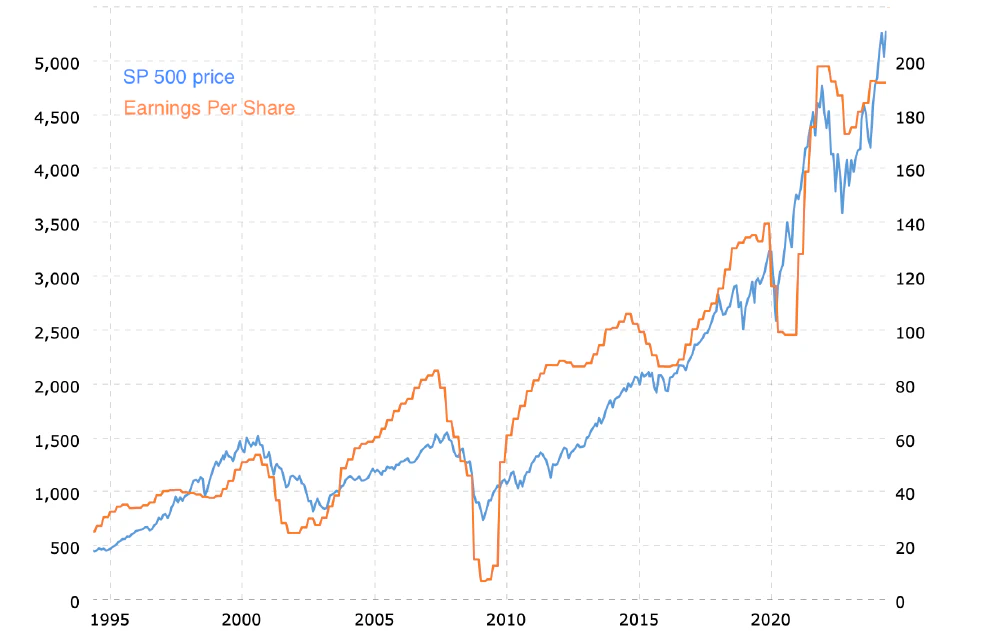

In the image above, we see two lines representing different aspects of the stock market: the blue line shows the S&P 500 price, while the orange line shows Earnings per Share (EPS). The S&P 500 price reflects the collective stock prices of the 500 largest U.S. companies, while EPS is a key measure of profitability, showing how much profit a company generates per share of stock.

As we can see, these two lines generally follow each other, especially over the long term. When companies earn more money (reflected in EPS), their stock prices tend to increase. While there may be temporary dips in the market, such as during economic downturns, the long-term trend has been upward, as earnings grow and the economy expands.

The Impact of AI and GenAI on Market Efficiency

Artificial Intelligence (AI) and Generative AI (GenAI) are set to transform business efficiency in ways that will profoundly impact the stock market. These technologies help companies optimize operations, make better decisions, and automate repetitive tasks. For instance, AI can analyze massive datasets to identify trends, improve customer experiences, and streamline supply chains.

Companies that adopt AI are likely to experience faster growth, increased profitability, and a competitive edge, all of which can lead to higher stock prices. As AI becomes more integrated into business processes, it’s expected to drive market efficiency to new levels, making companies more resilient and profitable.

Predicting 2025: Can the Market Keep Growing?

Predicting stock market growth in 2025 is tricky, as various factors like interest rates, inflation, and geopolitical events can influence the market. However, the long-term outlook remains optimistic. Technological innovation, including AI and GenAI, is expected to boost corporate earnings, leading to continued growth in stock prices.

While there may be volatility in the short term, the overall trend points toward growth. The S&P 500’s long history of resilience, even after market corrections, suggests that patient investors will benefit in the long run. So, while we can’t guarantee that the stock market will grow in 2025, the signs for future years are promising.

The Golden Rule of Investing: The Best Time to Invest Was Yesterday

One of the most important lessons for investors is that the best time to invest was yesterday. Time in the market beats timing the market. The stock market’s long-term growth makes it a valuable tool for building wealth, and trying to time the perfect entry point often results in missed opportunities.

Even during downturns, staying invested pays off. Historical data shows that missing just a handful of the stock market’s best-performing days can dramatically reduce long-term returns. So, whether the market grows in 2025 or takes a breather, the key is to stay invested and keep looking ahead.

Conclusion

The stock market, with its dynamic interplay of company performance, investor sentiment, and technological advancements, continues to be a barometer of economic health. As efficiency in business operations improves and innovations like AI and GenAI become more integrated, companies are set to achieve higher profitability and resilience. While predicting market movements can be challenging, the long-term trend indicates growth and expansion.

Engage with Us

Do you think AI will be the game-changer for future stock market growth? Let us know your thoughts and stay updated with expert insights on ML Alpha. Follow the top investors on ML Alpha and make informed decisions to generate Alpha.